FICA Tax: Understanding Social Security and Medicare Taxes

Por um escritor misterioso

Last updated 24 outubro 2024

Both employees and employers are required to pay FICA tax, which is withheld from an employee

Overview of FICA Tax- Medicare & Social Security

What is a payroll tax?, Payroll tax definition, types, and employer obligations

Understanding FICA (Social Security and Medicare) Taxes - MyIRSteam

SOCIAL SECURITY TAX AND THE MAXIMUM TAXABLE INCOME LIMIT

13 States That Tax Social Security Benefits

Understanding FICA, Medicare, and Social Security Tax

What is FICA Tax? - The TurboTax Blog

Understanding Your Paycheck

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

What are FICA Tax Payable? – SuperfastCPA CPA Review

What Are FICA Taxes And Do They Affect Me?, by M. De Oto

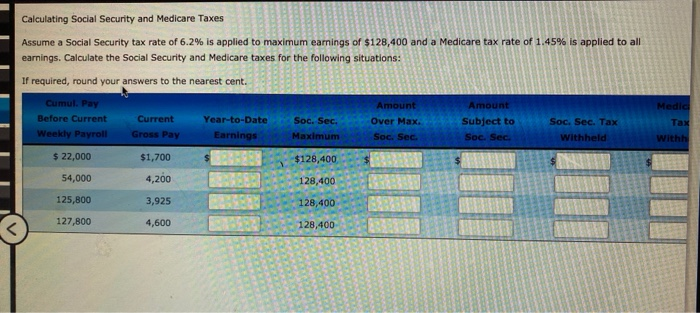

Solved Calculating Social Security and Medicare Taxes Assume

Federal Insurance Contributions Act - Wikipedia

FICA Tax Exemption for Nonresident Aliens Explained

Recomendado para você

-

Important 2020 Federal Tax Deadlines for Small Businesses - Workest24 outubro 2024

Important 2020 Federal Tax Deadlines for Small Businesses - Workest24 outubro 2024 -

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)24 outubro 2024

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)24 outubro 2024 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and24 outubro 2024

-

.jpg) What is FICA tax? Understanding FICA for small business24 outubro 2024

What is FICA tax? Understanding FICA for small business24 outubro 2024 -

Vola24 outubro 2024

Vola24 outubro 2024 -

IRS Form 843 - Request a Refund of FICA Taxes24 outubro 2024

IRS Form 843 - Request a Refund of FICA Taxes24 outubro 2024 -

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine24 outubro 2024

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine24 outubro 2024 -

2017 FICA Tax: What You Need to Know24 outubro 2024

2017 FICA Tax: What You Need to Know24 outubro 2024 -

FICA Tax Tip Fairness Pro Beauty Association24 outubro 2024

FICA Tax Tip Fairness Pro Beauty Association24 outubro 2024 -

Keyword:current fica tax rate - FasterCapital24 outubro 2024

Keyword:current fica tax rate - FasterCapital24 outubro 2024

você pode gostar

-

Order SUBARASHI - Memphis, TN Menu Delivery [Menu & Prices24 outubro 2024

Order SUBARASHI - Memphis, TN Menu Delivery [Menu & Prices24 outubro 2024 -

tartaruga ninja baby png - Clip Art Library24 outubro 2024

tartaruga ninja baby png - Clip Art Library24 outubro 2024 -

10 PC Games Every Teenager Needs to Play - Warped Factor - Words in the Key of Geek.24 outubro 2024

-

400 Robux - Other - Gameflip24 outubro 2024

400 Robux - Other - Gameflip24 outubro 2024 -

Toddler Wednesday Addams Family Costume Dress & Wig24 outubro 2024

Toddler Wednesday Addams Family Costume Dress & Wig24 outubro 2024 -

World Championship Deck: 2000 Brussels - Jon Finkel, World Champion - World Championship Decks - Magic: The Gathering24 outubro 2024

World Championship Deck: 2000 Brussels - Jon Finkel, World Champion - World Championship Decks - Magic: The Gathering24 outubro 2024 -

Papel de parede Adesivo Xadrez Moscou - Cabana do Mercador24 outubro 2024

Papel de parede Adesivo Xadrez Moscou - Cabana do Mercador24 outubro 2024 -

![AmiAmi [Character & Hobby Shop] POP UP PARADE BOCCHI THE ROCK! Hitori Gotoh Complete Figure(Pre-order)](https://img.amiami.com/images/product/main/233/FIGURE-160475.jpg) AmiAmi [Character & Hobby Shop] POP UP PARADE BOCCHI THE ROCK! Hitori Gotoh Complete Figure(Pre-order)24 outubro 2024

AmiAmi [Character & Hobby Shop] POP UP PARADE BOCCHI THE ROCK! Hitori Gotoh Complete Figure(Pre-order)24 outubro 2024 -

Peão peças de xadrez jogo de estratégia mármore resistido complexo des decoração objeto isolado em branco bg24 outubro 2024

Peão peças de xadrez jogo de estratégia mármore resistido complexo des decoração objeto isolado em branco bg24 outubro 2024 -

Rare deal knocks $100 off the PlayStation VR2 Horizon Call of the Mountain bundle at $50024 outubro 2024

Rare deal knocks $100 off the PlayStation VR2 Horizon Call of the Mountain bundle at $50024 outubro 2024