Itemize - Home

Por um escritor misterioso

Last updated 23 outubro 2024

Itemize automates B2B financial document processing, enhances risk assessment, and helps approve transactions via streamlined information flows and improved business intelligence.

Are you 'Kondo'ing' your home? There's a hidden tax benefit to tidying up – Press Enterprise

Are you paying more taxes than you have to? There are more than nineteen million home-based businesses in the United States—56 percent of all

Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses

Homeownership: Maximize Your Property Tax Deduction with These Tips - FasterCapital

Home Ownership Tax Deductions - TurboTax Tax Tips & Videos

How to Deduct Home Mortgage Interest When Filing Separately

Understanding the Mortgage Interest Deduction With TaxSlayer

Tax-reform changes will alter home-owning rationale for some

How to Deduct Home Mortgage and Interest Via Schedule A

FHA 203K Loan - How Much it Costs to Renovate a Home (Detailed Contractor Example) - Black Real Estate Agents

Standard Deduction vs. Itemized Deduction: How To Decide

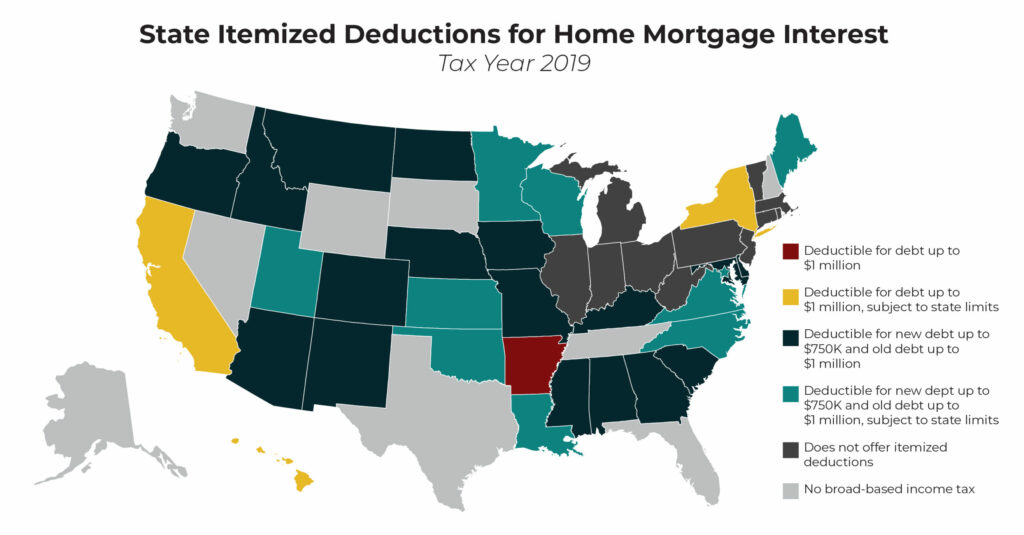

State Itemized Deductions: Surveying the Landscape, Exploring Reforms – ITEP

Recomendado para você

-

AutoNation Portal23 outubro 2024

-

QuickBooks Invoice Forms with Perforated Payment Voucher23 outubro 2024

QuickBooks Invoice Forms with Perforated Payment Voucher23 outubro 2024 -

What is 3-way matching in AP and why do you need to implement it?23 outubro 2024

What is 3-way matching in AP and why do you need to implement it?23 outubro 2024 -

Difference, Invoice vs Bill vs Receipt23 outubro 2024

Difference, Invoice vs Bill vs Receipt23 outubro 2024 -

Where can I find a tax invoice as was available prior to October? - Google Ads Community23 outubro 2024

Where can I find a tax invoice as was available prior to October? - Google Ads Community23 outubro 2024 -

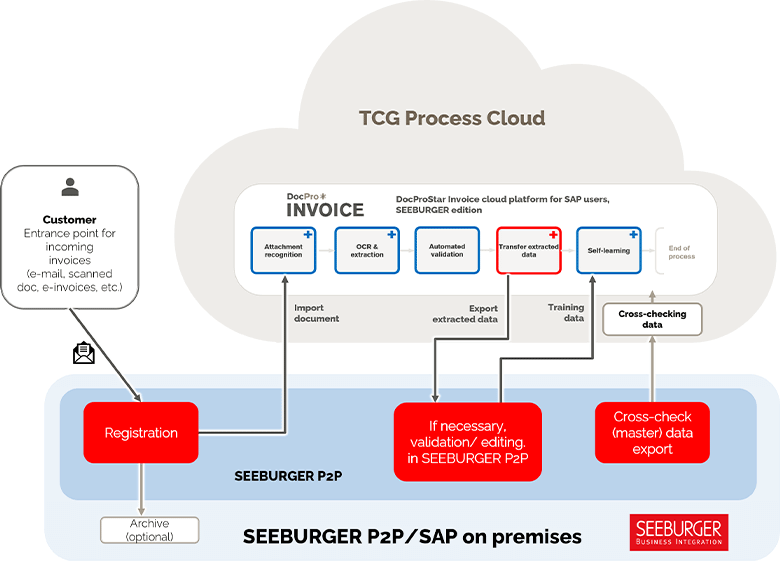

Cloud solution for SAP users23 outubro 2024

Cloud solution for SAP users23 outubro 2024 -

2-Way vs. 3-Way Matching: What's the Difference? - AvidXchange23 outubro 2024

2-Way vs. 3-Way Matching: What's the Difference? - AvidXchange23 outubro 2024 -

Know the difference: POs, packing slips, & invoices - Linnworks23 outubro 2024

Know the difference: POs, packing slips, & invoices - Linnworks23 outubro 2024 -

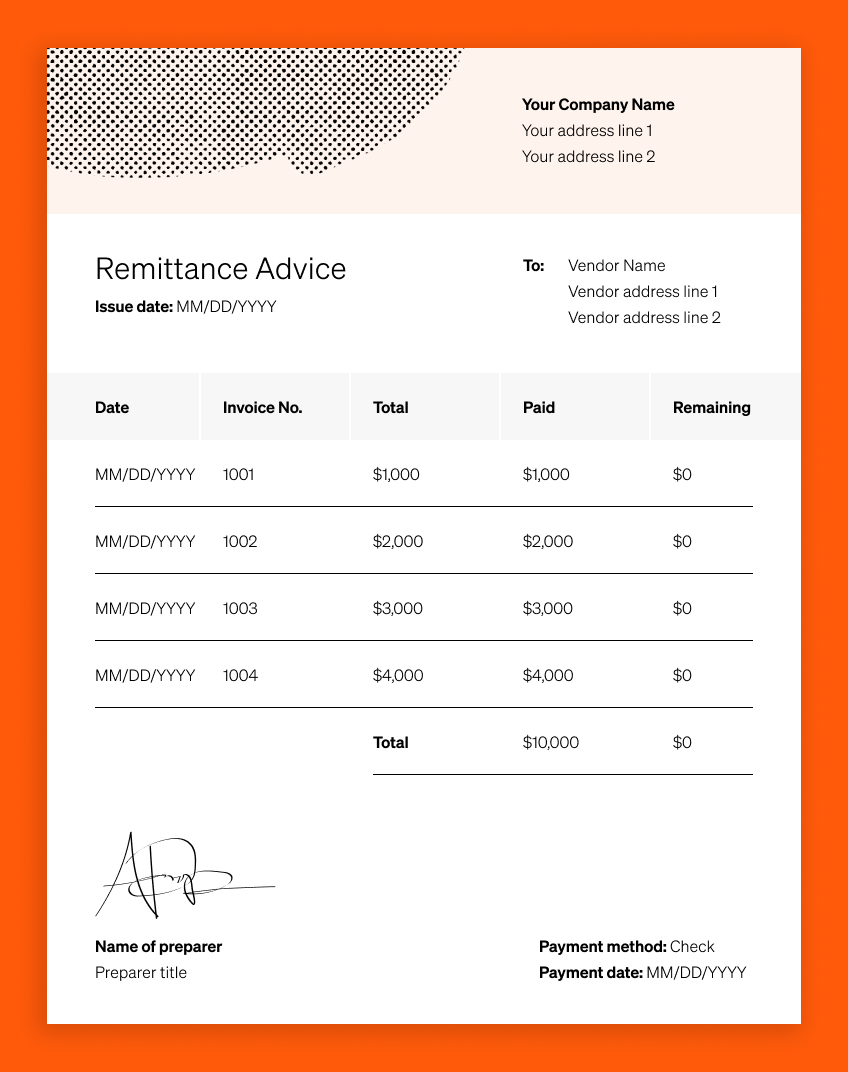

Remittance advice definition—and why it's useful23 outubro 2024

Remittance advice definition—and why it's useful23 outubro 2024 -

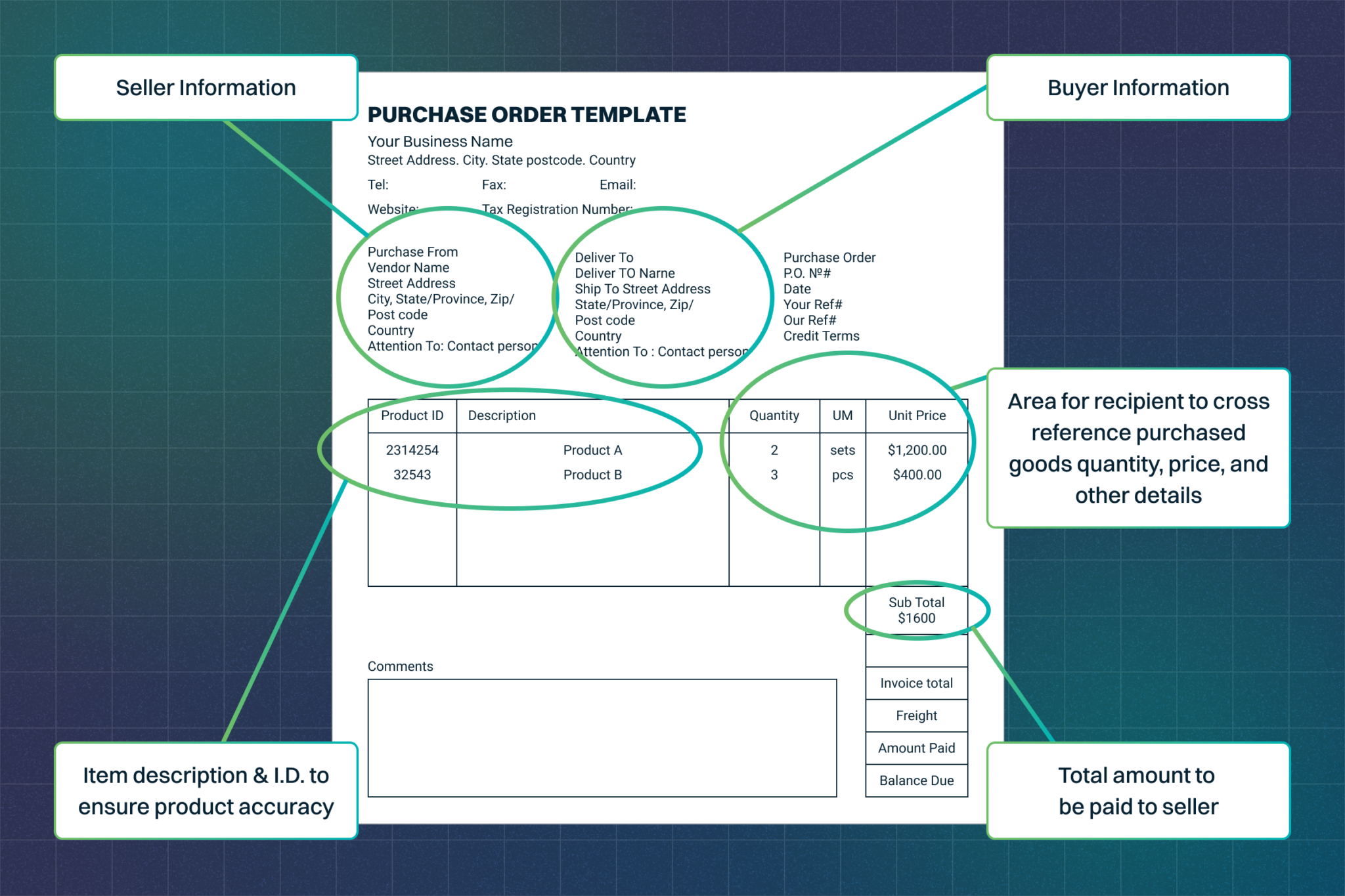

Free Purchase Order (PO) Template23 outubro 2024

Free Purchase Order (PO) Template23 outubro 2024

você pode gostar

-

Hall of Anime Fame: Quick Picks: Infinite Stratos S2 Ep 4, Valvrave the Liberator S2 Ep 3, Samurai Flamenco Ep 3, Log Horizon Ep 4, Yuushibu Ep 1-4, Kill La Kill Ep 1-423 outubro 2024

Hall of Anime Fame: Quick Picks: Infinite Stratos S2 Ep 4, Valvrave the Liberator S2 Ep 3, Samurai Flamenco Ep 3, Log Horizon Ep 4, Yuushibu Ep 1-4, Kill La Kill Ep 1-423 outubro 2024 -

Tiebreak23 outubro 2024

Tiebreak23 outubro 2024 -

⚔️🛡️ Belching Cramorant Moveset23 outubro 2024

⚔️🛡️ Belching Cramorant Moveset23 outubro 2024 -

Death Stranding Is Getting a Movie Adaptation23 outubro 2024

Death Stranding Is Getting a Movie Adaptation23 outubro 2024 -

Ia contra o único-jogador xadrez eletrônico jogo de xadrez magnético p – AOOKMIYA23 outubro 2024

Ia contra o único-jogador xadrez eletrônico jogo de xadrez magnético p – AOOKMIYA23 outubro 2024 -

Daily Streaming Review: Ascendance of a Bookworm23 outubro 2024

Daily Streaming Review: Ascendance of a Bookworm23 outubro 2024 -

Filme completo dublado sonic 223 outubro 2024

Filme completo dublado sonic 223 outubro 2024 -

Dragon Ball, VS Battles Wiki23 outubro 2024

Dragon Ball, VS Battles Wiki23 outubro 2024 -

Perfil Anime - Kiko huehue23 outubro 2024

-

SCARY MOVIE WASSUP! GHOST FACE STONED TONGUE COSTUME MASK 2023 TAG FW8511WU23 outubro 2024

SCARY MOVIE WASSUP! GHOST FACE STONED TONGUE COSTUME MASK 2023 TAG FW8511WU23 outubro 2024