DoorDash Tax Deductions, Maximize Take Home Income

Por um escritor misterioso

Last updated 22 outubro 2024

This article is the ultimate guide for DoorDash tax deductions. Click to read and learn what DoorDashers can write off.

Delivery Driver Expenses 2024: Does DoorDash Pay For Gas?

9 Best Apps To Track Mileage For DoorDash (2023)

Solo app guarantees Uber, Lyft, DoorDash workers an hourly income

How Much Should I Save for Doordash Taxes?

DoorDash Driver Review 2023: 8 Tips for Maximizing Earnings

Everything You Need to Know About 1099 Write Offs

DoorDash Taxes: How Does it Work

How Much Should I Save for Doordash Taxes?

7 Reasons Why All Gig Workers Need a Mileage Tracking App

How to File DoorDash Taxes DoorDash Drivers Write-offs

Track mileage with Everlance

The Complete Guide To Doordash Taxes

How Much Should I Save for Doordash Taxes?

Recomendado para você

-

Become a Dasher: Deliver with DoorDash22 outubro 2024

Become a Dasher: Deliver with DoorDash22 outubro 2024 -

Diary of a DoorDash Driver - Episode 322 outubro 2024

Diary of a DoorDash Driver - Episode 322 outubro 2024 -

DoorDash 15-minute delivery starts with employees - Protocol22 outubro 2024

DoorDash 15-minute delivery starts with employees - Protocol22 outubro 2024 -

Seattle mandates higher pay for third-party delivery drivers22 outubro 2024

Seattle mandates higher pay for third-party delivery drivers22 outubro 2024 -

DoorDash Driver Reviews - Food Delivery Guru22 outubro 2024

DoorDash Driver Reviews - Food Delivery Guru22 outubro 2024 -

DoorDash on X: Delivery drivers needed now! Our drivers choose22 outubro 2024

DoorDash on X: Delivery drivers needed now! Our drivers choose22 outubro 2024 -

DoorDash, Shifting Business Model, Will Offer Drivers Hourly Pay22 outubro 2024

DoorDash, Shifting Business Model, Will Offer Drivers Hourly Pay22 outubro 2024 -

Your DoorDash driver? He's the company's co-founder - The Columbian22 outubro 2024

Your DoorDash driver? He's the company's co-founder - The Columbian22 outubro 2024 -

DoorDash launches accelerator, grant program for women, minority restaurateurs - Bizwomen22 outubro 2024

DoorDash launches accelerator, grant program for women, minority restaurateurs - Bizwomen22 outubro 2024 -

DoorDash Driver - Willingboro, NJ - Nextdoor22 outubro 2024

DoorDash Driver - Willingboro, NJ - Nextdoor22 outubro 2024

você pode gostar

-

Guitar Flash Mania22 outubro 2024

-

Online gaming - BIK Portal22 outubro 2024

Online gaming - BIK Portal22 outubro 2024 -

Mako Island, H2O Just Add Water Wiki22 outubro 2024

Mako Island, H2O Just Add Water Wiki22 outubro 2024 -

Fantasia de pirata infantil eleva o charme do halloween em nova york22 outubro 2024

Fantasia de pirata infantil eleva o charme do halloween em nova york22 outubro 2024 -

PRÉ-VENDA Carro Barbie Signature Barbie The Movie Corvette22 outubro 2024

PRÉ-VENDA Carro Barbie Signature Barbie The Movie Corvette22 outubro 2024 -

Simon Says (1) (The Not-So-Tiny Tales of Simon by Reef, Cora22 outubro 2024

Simon Says (1) (The Not-So-Tiny Tales of Simon by Reef, Cora22 outubro 2024 -

Video-Highlights aus dem Sieg des TSV 1860 gegen Freiburg II22 outubro 2024

Video-Highlights aus dem Sieg des TSV 1860 gegen Freiburg II22 outubro 2024 -

Teddy Bear Hamster: Lifespan And Characteristics - Database Football22 outubro 2024

Teddy Bear Hamster: Lifespan And Characteristics - Database Football22 outubro 2024 -

Latest EA Sports FC 24 rumors suggests the Ultimate Team ratings22 outubro 2024

Latest EA Sports FC 24 rumors suggests the Ultimate Team ratings22 outubro 2024 -

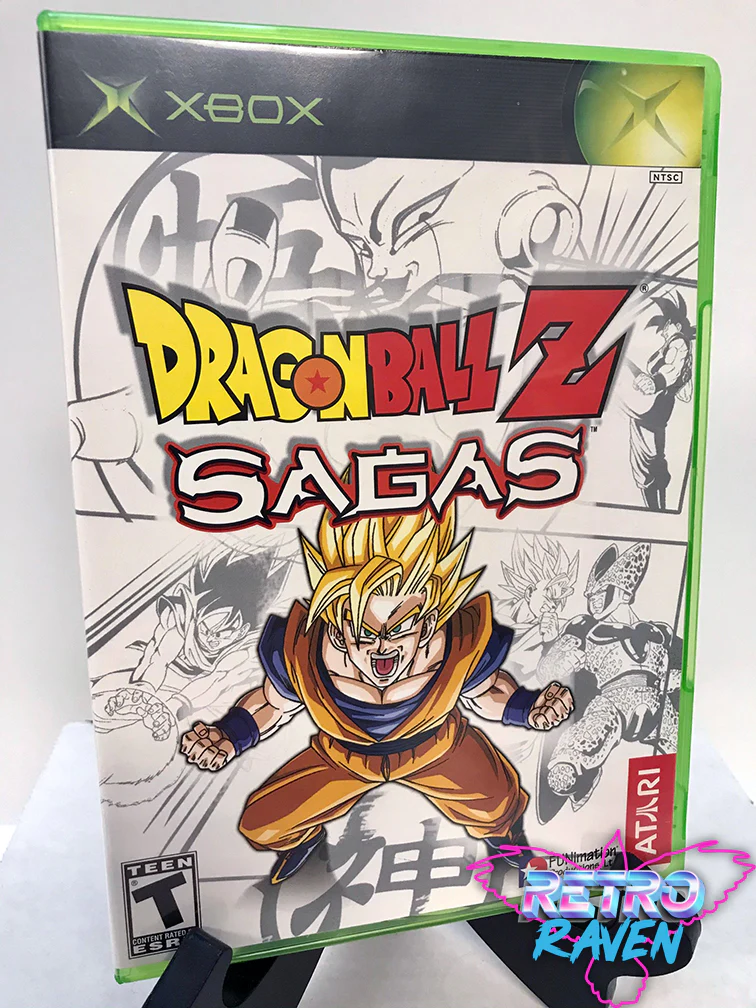

Dragon Ball Z: Sagas - Original Xbox22 outubro 2024

Dragon Ball Z: Sagas - Original Xbox22 outubro 2024